Reducing P&L volatility with hedge accounting

Since the introduction of IAS 39, hedge accounting has led to undesirable fluctuations in the P&L. While the underlying transactions maintain a constant balance sheet value, the hedging transactions have to be recognized as derivatives at their current market value. This mismatch can be resolved by means of hedge accounting and thus reconciled from an economic and accounting perspective. In addition, the hedge accounting methods and parameters should be consistent with risk control.

Hedge accounting with zeb.control

The following range of services from zeb.control enables you to master the challenges of hedge accounting with ease:

- Support of cash flow and fair value hedge accounting as well as local GAAP hedge accounting managed at overall bank level

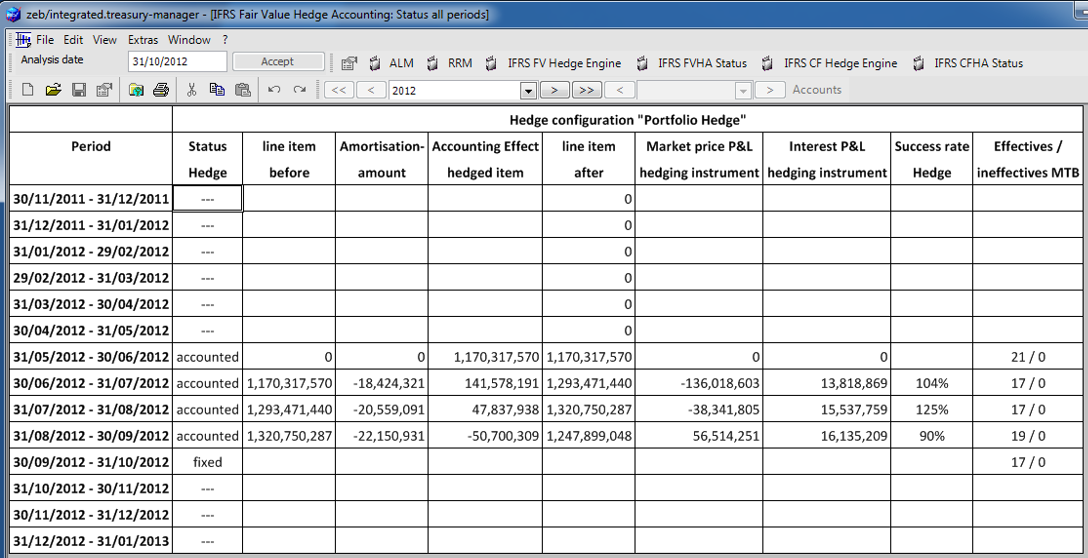

- Full support of controlling and treasury management processes, from creating the hedge relationship, through to executing effectiveness tests, determining posting effects and subsequent plausibility checks

- The features also include extensive simulation options, audit-proof documentation of the hedge process and the competence system with logging

- Numerous customizable standard reports

Experience the versatile possibilities of zeb.control live!

The following product video shows the extensive functions of the software and demonstrates exemplarily how you can access the multilayered possibilities from data import to configuration and analysis creation.

- Comprehensive knowledge and best-practice implementation by zeb

- Optimized process: adaptation and documentation within a few days

- The multi-curve capability covers the current audit requirements

➥ Efficient solution with customizing options — fast, flexible and easy to use

Excerpt of our customers

Your contact persons

Apps that might also interest you

Articles you might be interested in