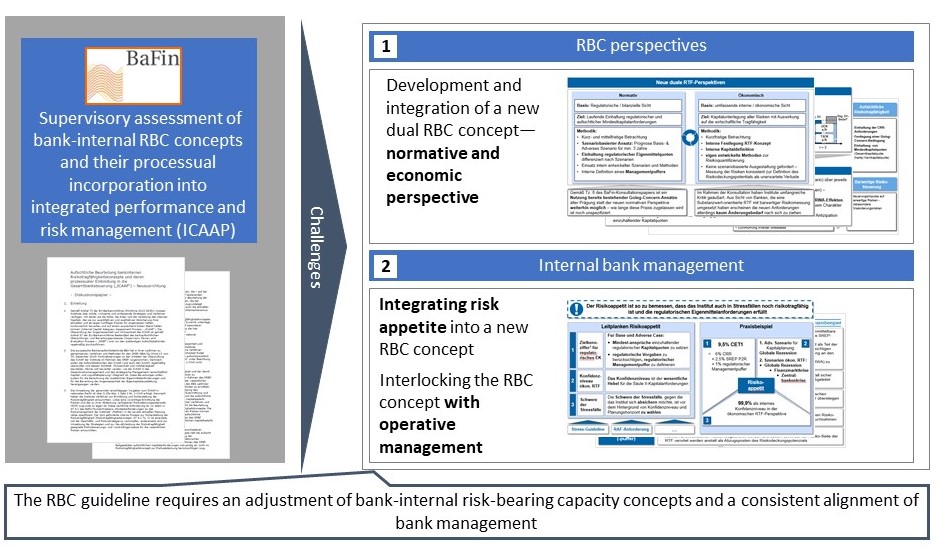

Challenges

Increased requirements for risk-bearing capacity concepts and bank management

BaFin has specified its requirements for risk-bearing capacity concepts as part of a pan-European harmonization of ICAAP procedures. The new RBC guideline requires an adjustment of banks’ internal risk-bearing capacity concepts and a consistent alignment of bank management

Solutions

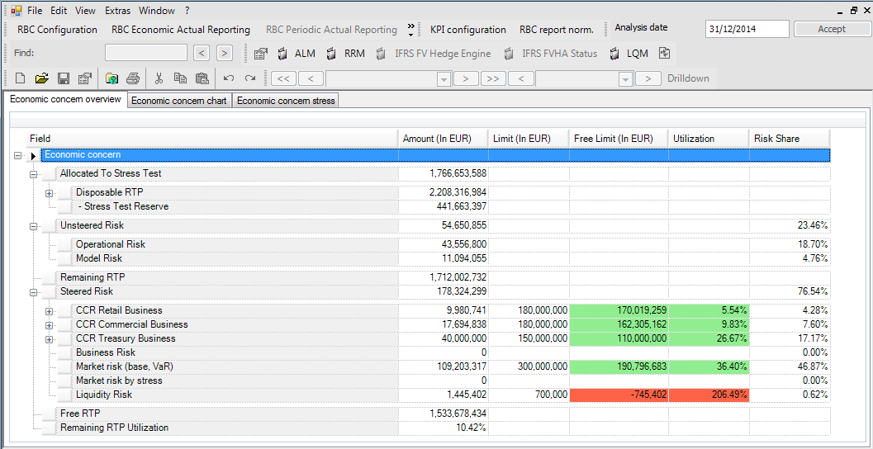

zeb offers an effective risk management tool for integrated risk analysis and simulation for a financial institution’s risk controlling.

Comprehensive simulation of risk indicators including ICAAP / ILAAP indicators from a normative and economic perspective

- Flexible selection of indicators to be taken into account when determining the risk-bearing capacity

- Normative approach: scenario-dependent minimum capital ratios and intuitive definition of basic and adverse scenarios

- Economic approach: configuration of the RCP calculation, flexible options for risk calculation and definition of stress scenarios for scenario and sensitivity analyses

- Comprehensive diagnosis reports on credit risk indicators

Benefits

- zeb’s expert knowledge of legal and regulatory requirements

- Compliance with current BaFin requirements through a dual RBC concept

- Transparency about the risk situation of your company

- Sustainability through continuous development with regard to professionalism and usability

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you