Challenges

Strict regulatory requirements call for professional trading processes

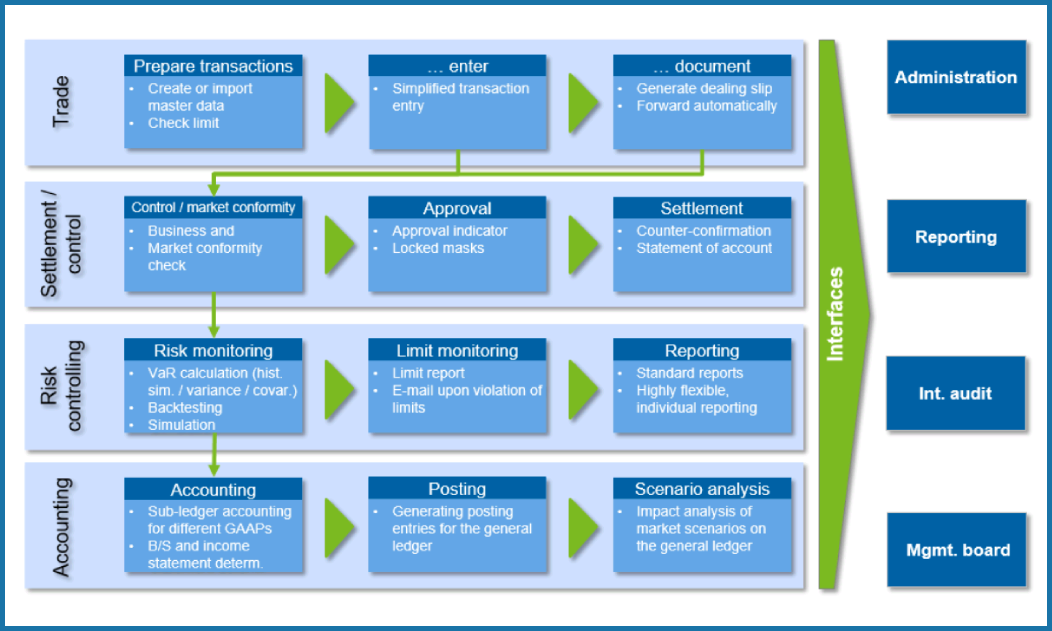

Continuously increasing regulatory requirements, such as MaRisk and a high market volatility, require banks to maintain professional and efficient trading and settlement systems. In the complex proprietary trading business, it is crucial to have quick and easy access to all information relevant to decision-making. Furthermore, the trading process between the trading and settlement departments, right through to risk management, must be controlled and documented.

Solutions

Solutions for efficient support trading processes

- The Treasury module supports your proprietary trading processes, taking into account MaRisk requirements. The following functionalities are available:

- Transaction data input, portfolio management and (mark-to-market and mark-to-model) valuation for proprietary trading

- Comprehensive securities and derivatives product catalog

- Determination of income indicators under commercial law as well as of performance

- Flexible structuring of the inventory by portfolio and detailed evaluations

- Differentiated limit system including pre-deal limit checks

- Dealing slip and deadline monitoring function

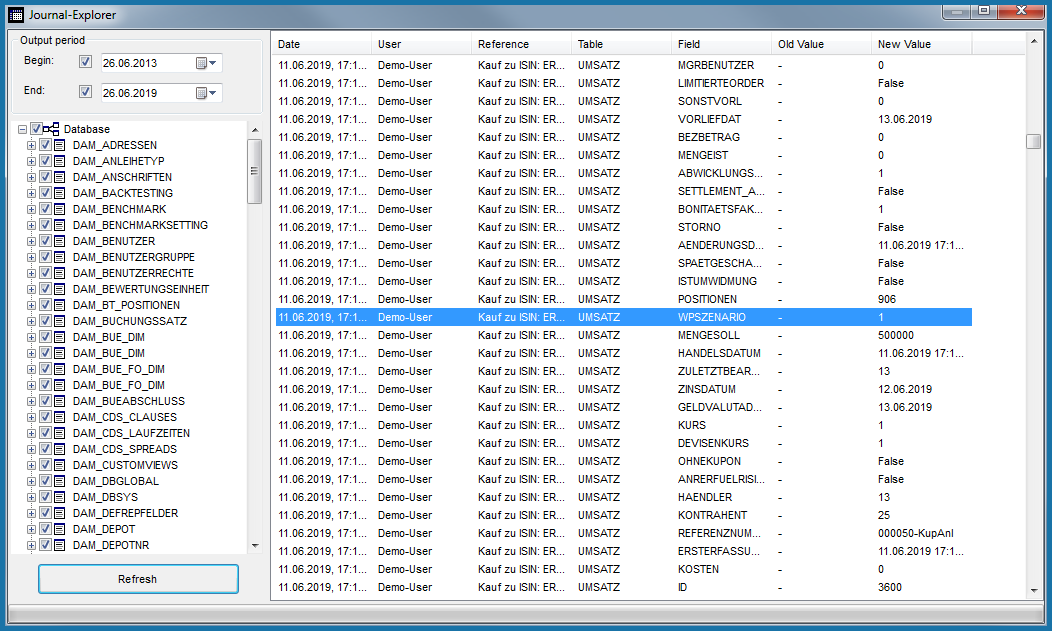

- Audit-proof documentation of all process steps including dual-control principle for approvals

Benefits

- Time-saving through automatic trade workflow documentation and generation of dealing slips, etc.

- A comprehensive legal system ensures compliance

- Flexible adaptation of portfolios, evaluations and the limit system to individual requirements with a mouse click

References

Excerpt of our customers

Contact

Your contact persons

Related Apps

Apps that might also interest you

Articles

Articles you might be interested in